Millage rate calculator

Lastly there are additional city property taxes in 10 Mobile County cities. The average county and municipal millage rate is 30 mills.

Hennepin County Mn Property Tax Calculator Smartasset

Plan your route estimate fuel costs and compare vehicles.

. Make sure you review your tax card and look at comparable homes. The rate for these types of contracts is 35 cents per 100 of value. Enter Other TOTAL MILLS.

Then you could use a property tax calculator to come up. In Mobile city the municipal rate is 70 which brings the total millage rate for residents of Mobile city to 635. Millage is the tax rate expressed in decimal form.

Senior Exemptions are not taken into account for the estimated tax amount. Enter School District Millage. The State millage rate on all real and personal property has been phased out.

Your Taxes may be higher or lower. This estimate does not include any Non-Ad Valorem assessmentsFees Fire Garbage Light Drainage. The calculator will automatically apply local tax rates when known or give you the ability to enter your own rate.

It represents the number of dollars taxed per every 1000 of a propertys assessed value. A millage rate is one tenth of a percent which equates to 1 in taxes. In our calculator we take your home value and multiply that by your countys effective property tax rate.

For example if the local property tax rate on homes is 15 mills homeowners pay 15 in tax for every 1000 in assessed home value. A stamp tax of 70 cents per 100 of value is assessed on documents that transfer interest in Florida real estate such as warranty deeds and quitclaim deeds. Enter Municipality Millage.

On January 1 2016 there was no State levy for ad valorem taxation. A tax is also levied on notes bonds mortgages liens and other written obligations to pay that are filed or recorded in Florida. Property taxes in Florida are implemented in millage rates.

Property taxes are calculated by multiplying your municipalitys effective tax rate by the most recent assessment of your property. Enter County Millage. Property taxes sometimes referred to as a millage rate or a mill tax is a tax that you pay on real estate and other distinct types of property.

Millage rates are determined by the county commissions and other taxing agencies. The amount that you owe each year depends on the assessed value of your property including your house itself and the land that it sits on. In 2015 the State millage rate was 05.

To find the propertys tax amount millage rates are applied to the total taxable value of the land. A mill is one-tenth of one cent 001 1 mill 0001. Once the assessed value of your property has been determined multiply it by the appropriate millage rate for the area in which you live.

This tax estimator is based on the average millage rate of all Broward municipalities. Inside Mobile and Pritchard the additional millage is 120 while outside those two cities the additional millage is just 40. Ok just use the millage calculator.

The Estimated Tax is just that an estimated value based upon the average Millage Rate of 200131 mills or 200131. Accordingly a house with a 200000 assessed value would be. Use this Louisiana property tax calculator to estimate your annual property tax payment.

The estimated tax amount using this calculator is based upon the average Millage Rate of 200131 mills or 200131 and not the millage rate for a specific property. This is equal to the median property tax paid as a percentage of the median home value in your county. 1 You have chosen.

A millage rate is the tax rate used to calculate local property taxes. If you would like to calculate the estimated taxes on a specific property use the tax estimator on the. A tax rate of one mill represents a tax liability of one dollar per 1000 of assessed value.

What is a millage rate. Enter millage rate. You can move the decimals by 10 100 or 1000.

Property Tax And Millage Calculator Anytime Estimate

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Property Tax Tax Rate And Bill Calculation

Property Tax Millage Rate 13 Things 2022 You Need To Know

Property Tax How To Calculate Local Considerations

Property Tax Millage Rate 13 Things 2022 You Need To Know

New York Property Tax Calculator 2020 Empire Center For Public Policy

Washington County School District Tax Rates Millage

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Property Tax Calculator

The Property Tax Equation

Allegheny County Property Tax Assessment Search Lookup

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

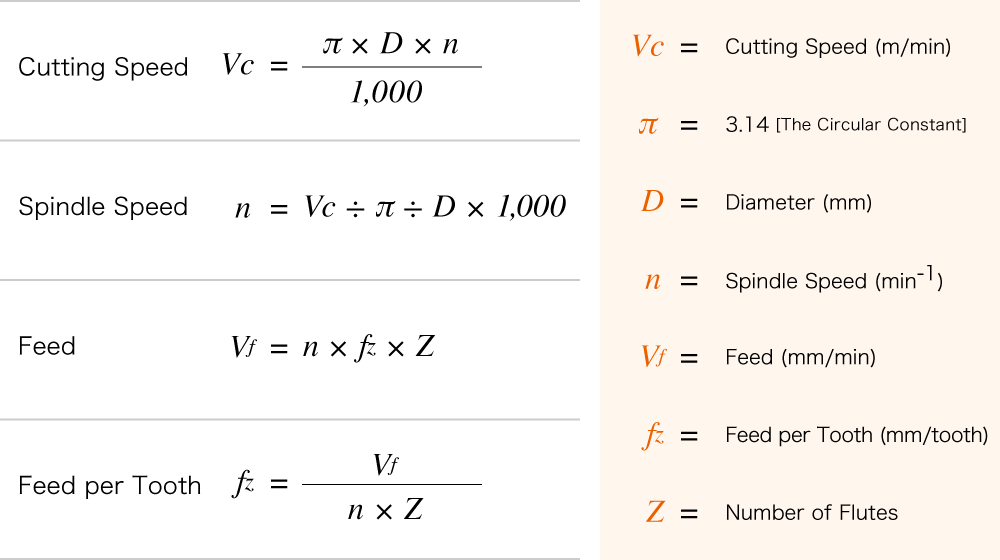

Calculation For Cutting Speed Spindle Speed And Feed Ns Tool Co Ltd

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Millage Rates And Real Estate Property Taxes For Macomb County Michigan